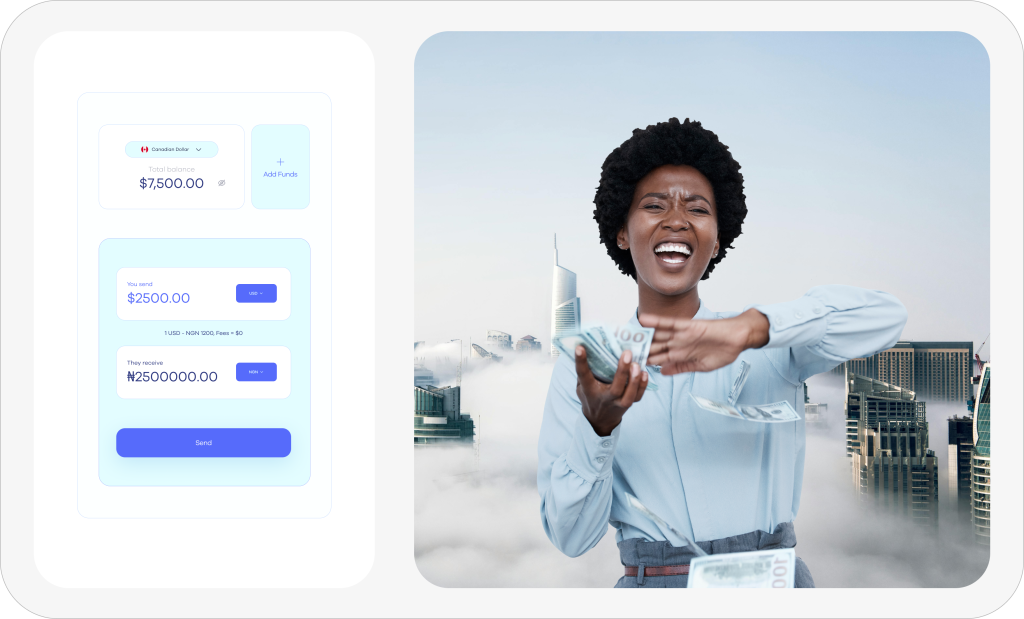

PadiePay

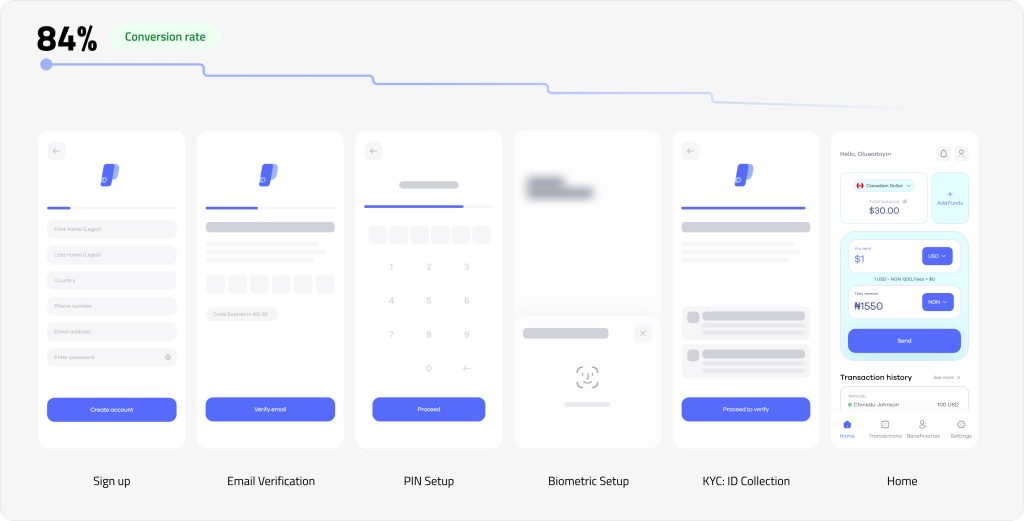

Redesigning Onboarding for Speed, Compliance, and Conversion

Results at a Glance

80% faster onboarding (10 mins → 2 mins)

100% KYC compliance across regions

37% drop in onboarding abandonment

Designed a modular onboarding system that adapts to regional KYC laws while delivering a frictionless user experience.

Overview

PadiePay is a cross-border remittance platform for users in Canada, the U.S., and Europe, primarily serving the African diaspora. As we expanded, a major challenge emerged: how to ensure seamless, fast onboarding while complying with diverse KYC regulations in each region. Our goal was to design an onboarding experience that minimized friction, maximized trust, and fully complied with local laws.

Problem

Cross-border remittance apps must navigate complex KYC requirements that vary by region. For users, this often means long forms, unfamiliar documentation requests, and delays in account activation leading to high drop-off rates. We aimed to solve three core issues:

Reduce time-to-onboard without compromising compliance.

Adapt KYC requirements dynamically based on location.

Minimize drop-offs with a simplified and transparent onboarding flow.

Design Process

1. Research & Insights

1. Product Inquiry & Internal Audits

We began by reviewing internal onboarding data across regions (Canada, U.S., Nigeria):

- Drop-off Analytics: Identified major drop-off points at the ID upload and address verification stages.

- Customer Support Logs: Revealed recurring complaints about rejected IDs and unclear documentation instructions.

- KYC Backend Review: Mapped how existing KYC checks were being triggered and where delays occurred (e.g., slow third-party verification responses in West Africa).

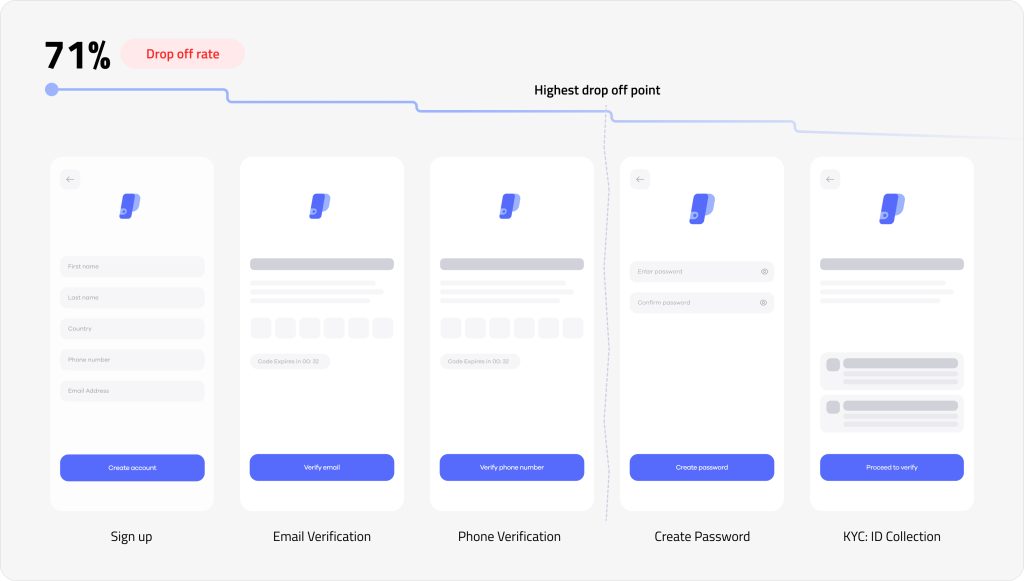

Iteration 1: 71% drop-off rate from app installation to KYC ID collection

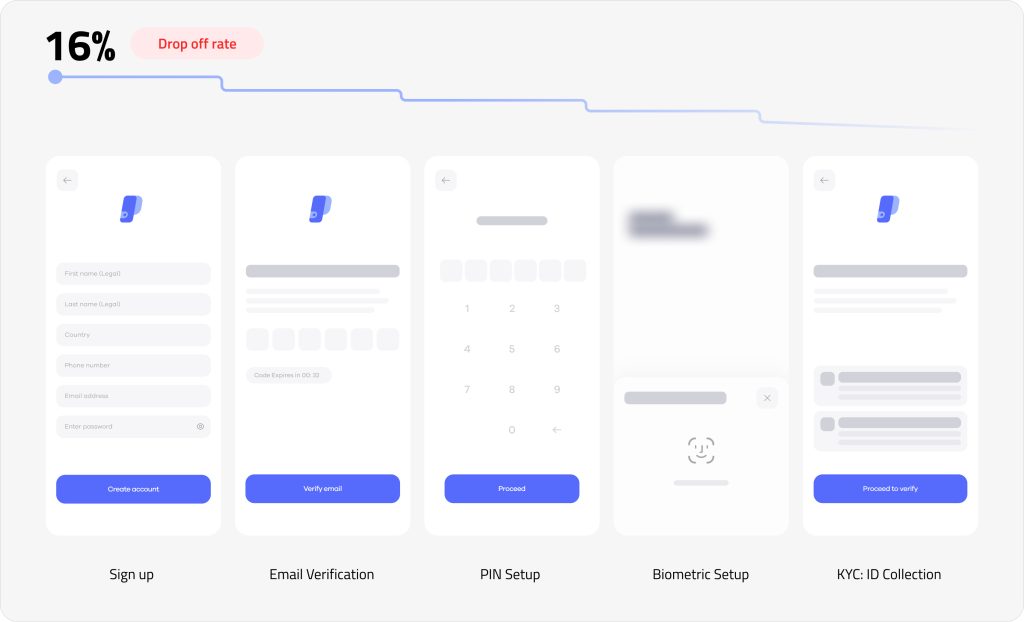

Iteration 2: By unifying the for screens we were able to reduce the drop off rate by 55%

Iteration 3: 84% customer conversion rate after we introduced progressive disclosure

2. Competitor Benchmarking

We analyzed onboarding flows from 5 top remittance competitors:

- Sendwave

- Wise (formerly TransferWise)

- Remitly

- Chipper Cash

- LemFi

From these, we noted:

- Wise minimized upfront KYC friction by using just-in-time verification at transaction time.

- Chipper Cash adapted onboarding steps based on geolocation without overwhelming users.

- Remitly provided region-specific document examples and real-time photo feedback, which inspired our AI-powered image guidance.

3. Session Replays & Funnel Analysis

Using Hotjar and Mixpanel:

- Session recordings showed users hesitating or abandoning the process during document upload.

- Funnel metrics revealed a 54% drop between basic info entry and ID submission in Nigeria, and a 42% drop in Canada at the address proof step.

- Users struggled with knowing what documents were accepted and how many steps were left.

4. Usability Testing

We ran 7 moderated usability tests (remote) with users from:

- Canada (2)

- U.S. (3)

- Germany (1)

- Nigeria (1)

Key insights:

- Users expected to complete onboarding in under 3 minutes.

- Nigerian users struggled with the lack of feedback on BVN entry errors.

- U.S. users were unsure if driver’s licenses or passports were accepted without clearer instructions.

5. User Interviews

Conducted 3 in-depth interviews with repeat users and early adopters. Findings included:

- First-time users felt anxious about uploading sensitive ID without understanding why it was required.

- Many preferred to “start exploring” the app before being forced into full verification.

- Users valued transparency clear indicators of how many steps were left significantly reduced drop-offs.

- Synthesis:

These combined methods validated our core assumptions: - Onboarding needed to be modular, region-aware, and visually guided.

- Trust and transparency were key levers to increase completion rates.

- Speed and just-in-time verification were necessary to match user expectations in competitive markets.

2. Personas & Journey Mapping

User Personas & Journey Goals

We designed for two core personas:

Newcomers: First-time remittance users, unfamiliar with digital KYC.

Frequent senders: Familiar but want speed and simplicity.

Each user journey focused on:

Building trust early with clear steps and visual guidance.

Adapting documentation requests per region.

Reducing total onboarding time without information overload.

3. Solution Design

We broke onboarding into three progressive steps:

Basic Info & Verification

Fields: Name, email, phone.

Auto-fill and inline validation reduced entry errors.

OTP verification enabled users to explore the app before full KYC.

ID Verification

KYC adjusted dynamically by region:

🇳🇬 Nigeria → BVN

🇺🇸 U.S. / 🇨🇦 Canada → Passport / Driver’s License

Integrated real-time document capture + AI-based quality checks.

Address & Currency Setup

Users selected country and currency.

Verification docs requested contextually (e.g., utility bill).

Localization included native language (e.g., French), exchange rates, and fee previews.

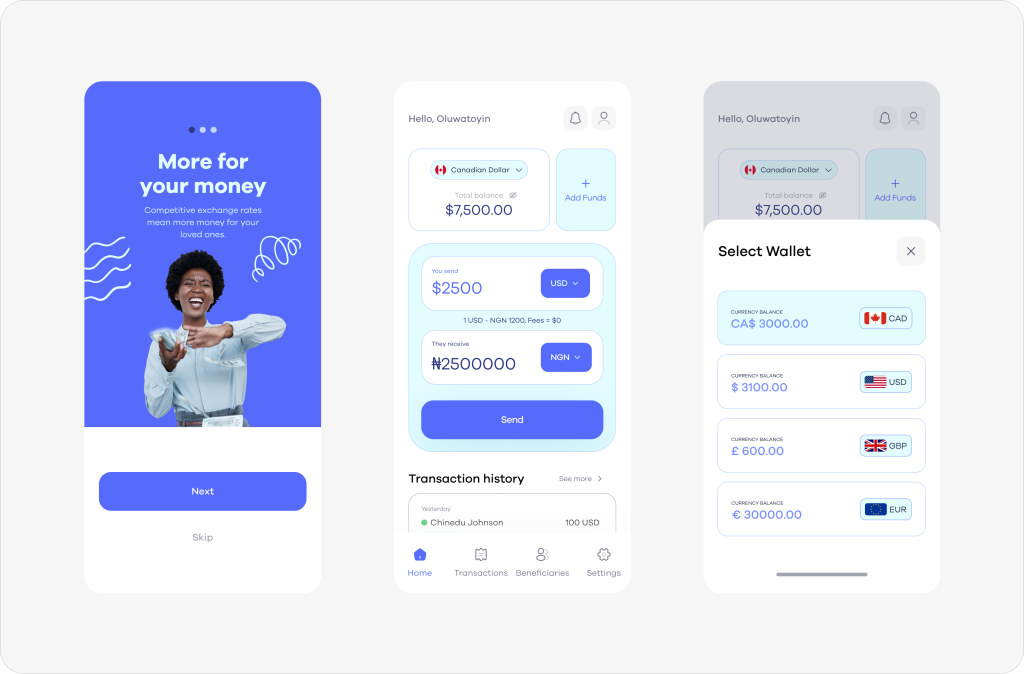

4. Localization & Multi-Currency Handling

Handling Currency & Regional Compliance

Integrated IP/geolocation detection to adapt onboarding steps.

Automatically applied country-specific KYC logic.

Currency selection with localized exchange rate previews and regional fee breakdowns.

Language localization supported French & English.

5. Product Strategy

UX/UI Considerations

Progressive Disclosure: Reduced overwhelm by revealing fields step-by-step.

Microinteractions: Helped users feel progress during uploads and verifications.

Minimalist Layout: Focused attention on actions with less distraction.

Progress Tracker: Visual indicator showed step completion and reduced anxiety.

Technical & Regulatory Challenges

| Challenge | Solution |

|---|---|

| Varying KYC laws | Built modular flow triggered by backend logic based on user’s region. |

| Poor document uploads | Real-time AI-based image quality feedback + native camera integration. |

| Onboarding drop-offs | Save-and-resume flow + soft reminder emails for incomplete signups. |

Outcome

80% reduction in onboarding time (10 mins → 2 mins)

37% decrease in drop-off rate

100% KYC compliance across all supported countries

Key Learnings

Adaptability builds trust: Users felt more confident when the app adapted to their country, language, and ID norms.

Transparency reduces churn: Showing users what’s needed and why reduced uncertainty.

Ongoing testing drives results: Frequent usability tests helped us catch friction early and refine the experience iteratively.