Rex Africa

Transforming Loan Access for 8,000+ Merchants Through Inclusive Digital Design

Overview

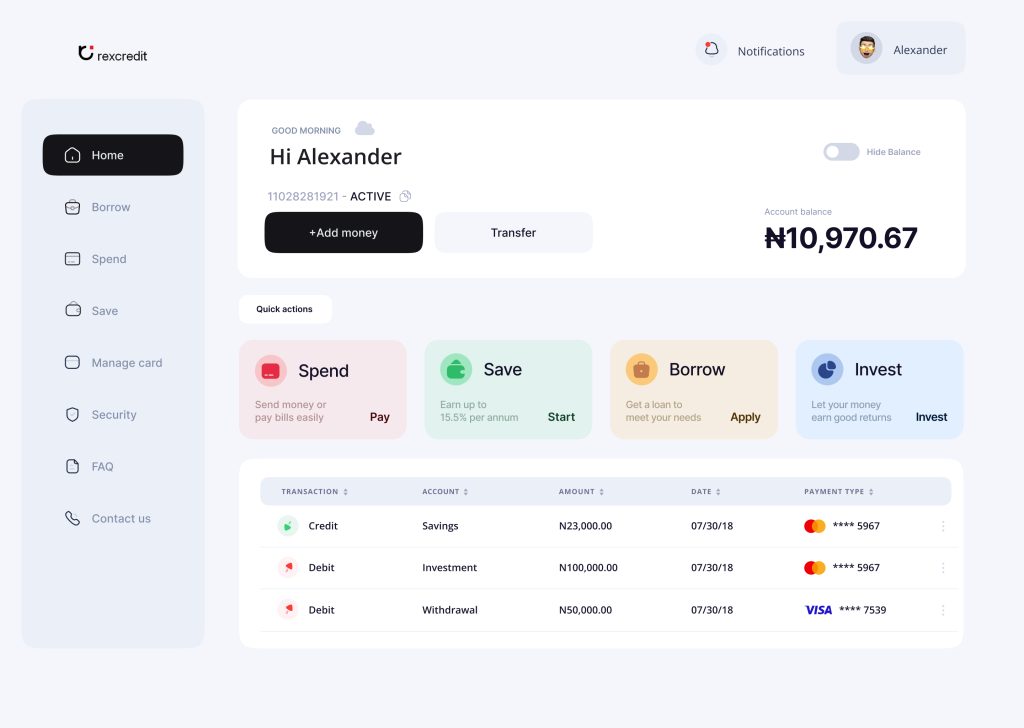

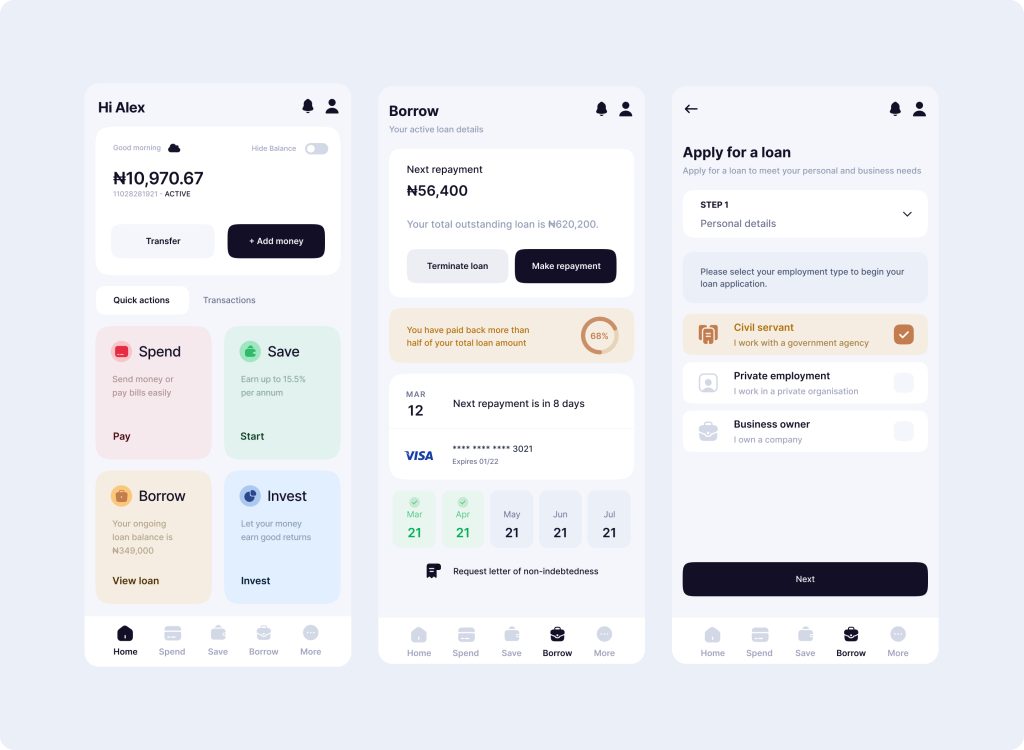

Rex Africa, once a branch-based microfinance bank, relied on manual loan processes that limited reach and slowed disbursement. As mobile banking surged across Africa, they set out to digitize loan access especially for underserved merchants and a rising class of young entrepreneurs.

Our challenge: Build a mobile-first loan experience that preserved trust for existing customers while appealing to a tech-savvy audience.

Problem Statement

The manual loan process was slow, confusing, and inaccessible:

-

Merchants had to visit branches, fill out paperwork, and wait days for feedback.

-

Younger users, used to mobile-first banking, found the process outdated and frustrating.

-

Lack of transparency and trust in digital terms discouraged adoption.

Without a digital alternative, Rex Africa risked losing relevance with its next generation of customers while failing to serve existing ones efficiently.

Design Goals

Our solution needed to balance simplicity and trust:

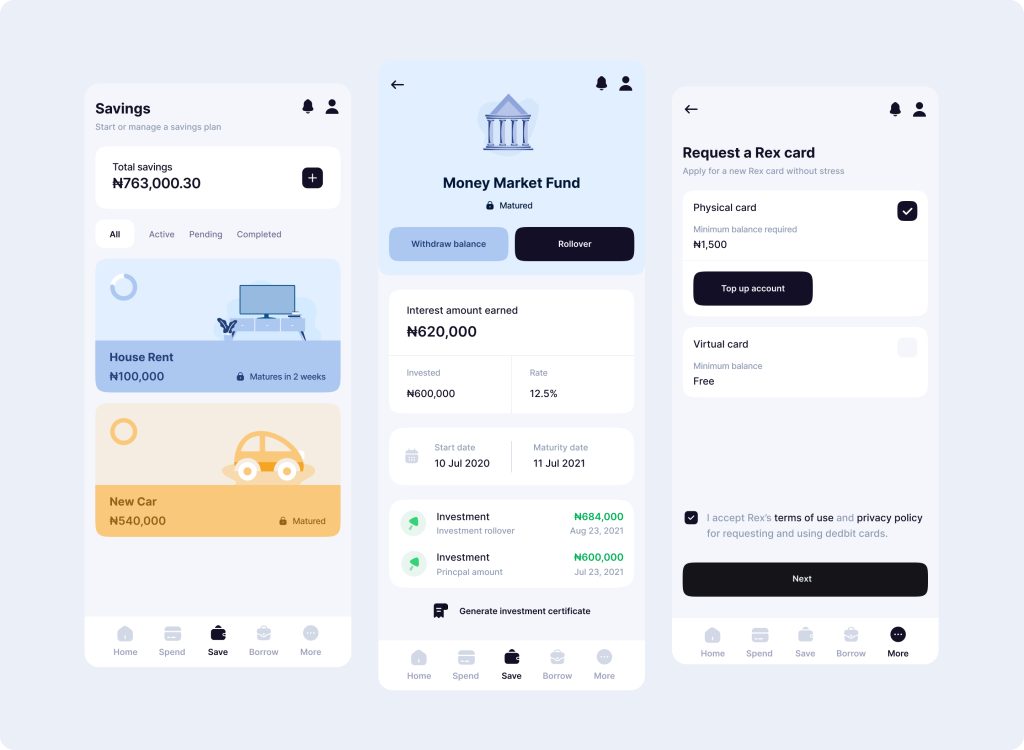

Speed & Clarity: Users needed loans in hours, not days.

Accessibility: Market sellers required intuitive flows with local language and low digital literacy barriers.

Appeal to Young Users: A mobile-first, modern UI was crucial for adoption.

Trust & Transparency: Clear interest rates, repayment terms, and approval feedback were essential to gain user confidence.

Research

We conducted research in two phases:

- Field Research with Market Sellers & Merchants: Interviews and shadowing sessions were conducted in local markets to observe the existing loan application process. We learned that merchants valued quick access to loans but were intimidated by complex processes. Trust in digital banking was low, so the application needed to feel safe and transparent.

Insight: Merchants feared digital loans due to unclear terms and language barriers.

Design Implication: Use visual explanations, and simplified copy.

- Surveys and User Testing with Younger Audiences: Younger users, mostly between the ages of 18–30, were interested in quick loans for personal and business needs. They valued speed, convenience, and a modern UI that reflected trust and professionalism.

Insight: Wanted fast loans with mobile disbursement, and had high design expectations.

Design Implication: Modern UI, instant feedback, and mobile money integration.

Design Process

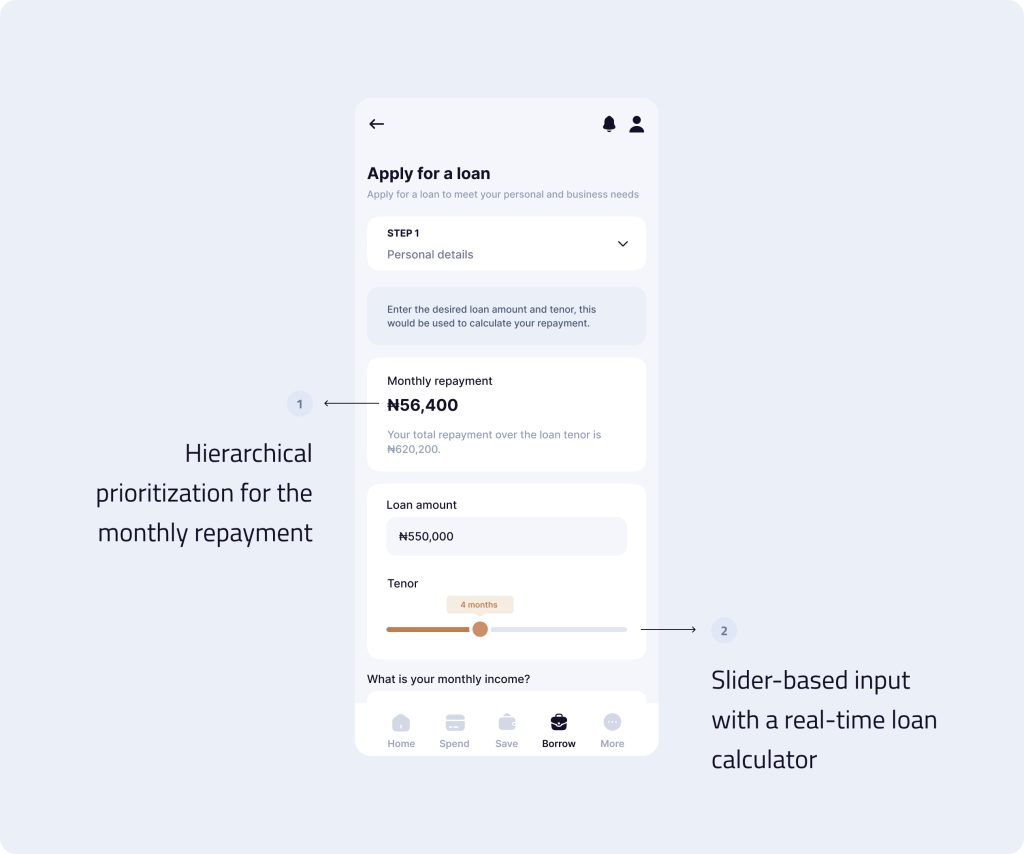

Step 1: Loan Request

Problem: Users didn’t understand how much they’d owe.

Solution: We added a slider-based input with a real-time loan calculator showing total repayment.

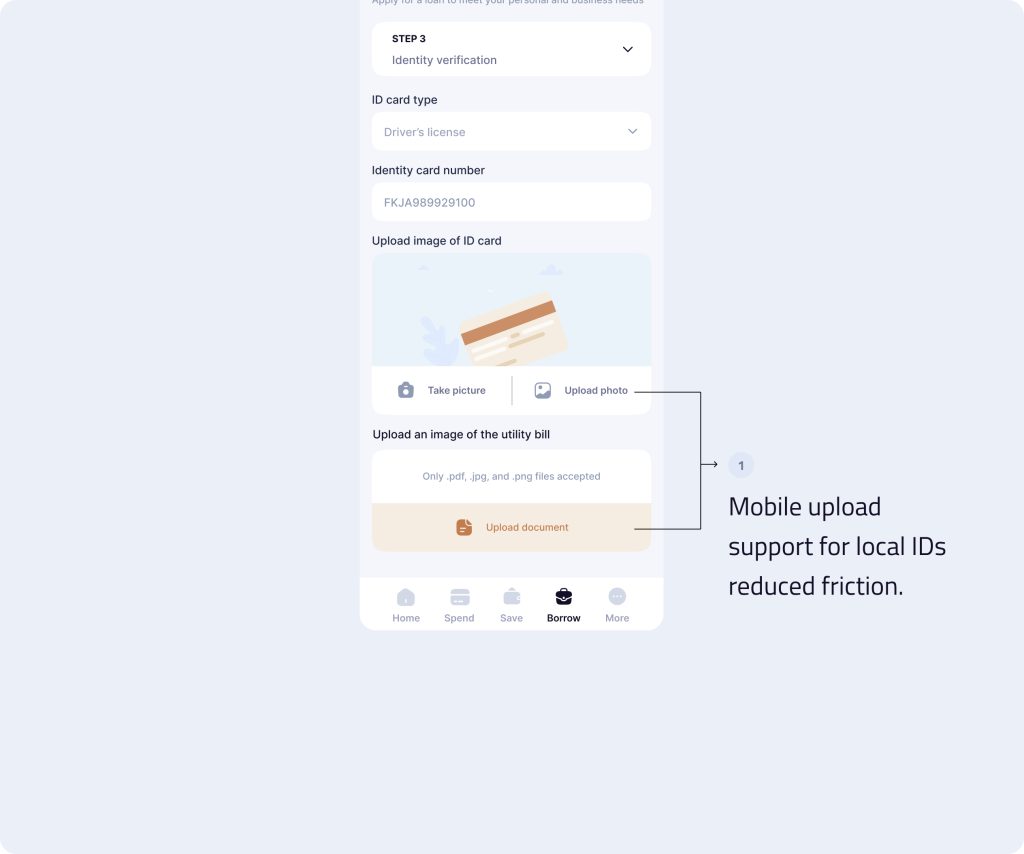

Step 2: Eligibility Check

Problem: Manual document collection delayed approvals.

Solution: Soft credit checks + mobile upload support for local IDs reduced friction.

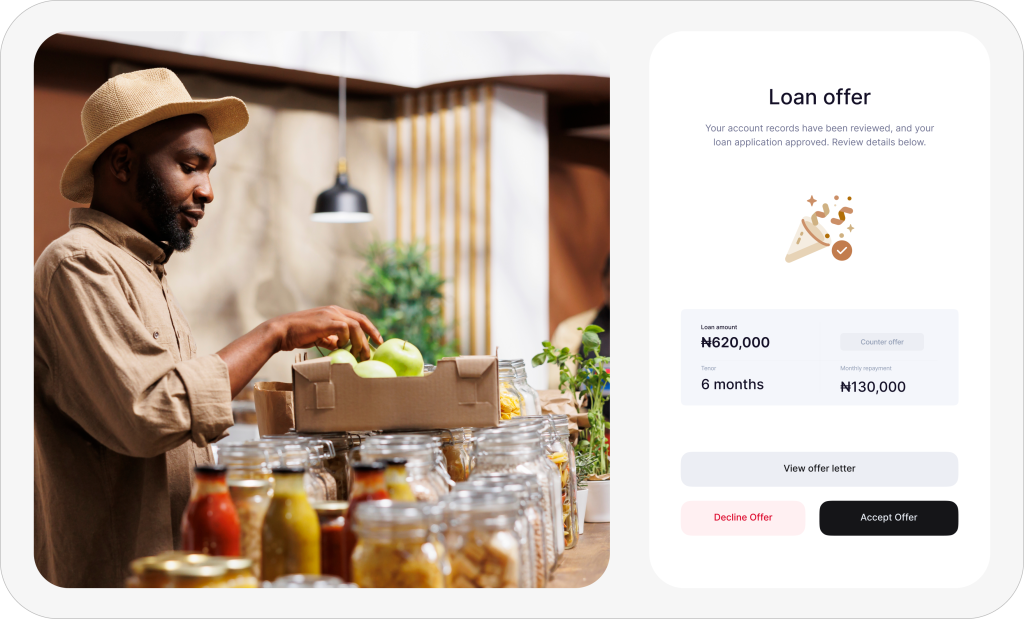

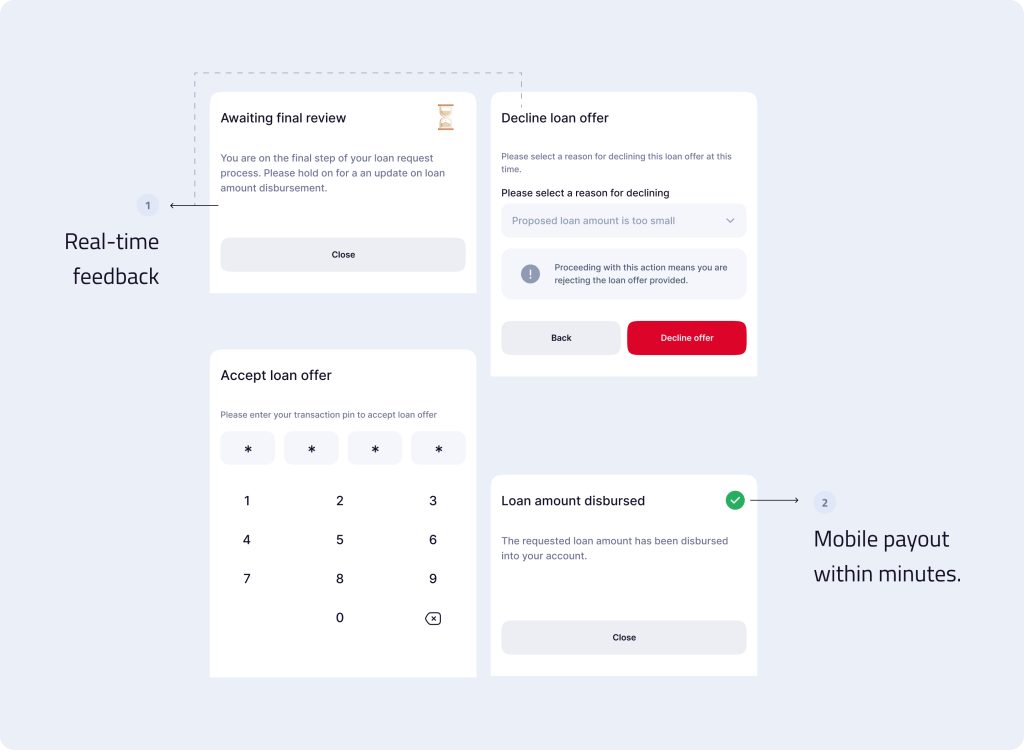

Step 3: Approval & Disbursement

Problem: Waiting days for funds created stress.

Solution: Real-time feedback and mobile money payout within minutes.

Design Iterations

Based on feedback:

- We simplified the language in the app even further, especially in the loan terms section, to cater to lower literacy levels.

- Added a step-by-step tutorial for first-time users to reduce the learning curve, particularly for older merchants.

- Introduced push notifications and reminders to help users stay on track with their loan repayments.

Final Design

The final product is a mobile loan app designed for inclusion and speed balancing the needs of tech-savvy youth and non-digital natives. With local language support, transparent repayment, and instant access to funds, it empowers 8k+ users with fair, fast credit.

Outcome

Since launching the app, Rex Africa has seen:

- A 25% increase in loan applications, with 64% of new applicants being younger users.

- Faster loan disbursement, with over 71% of applications processed within 24 hours.

- Positive feedback from local merchants who appreciate the new accessibility, with over 88% reporting satisfaction with the process.